A Young Person’s Guide to Financial Well-Being

Saving money and financial well-being, similar to physical health, are made up of thousands of seemingly innocuous daily decisions. Save a few bucks here, buy a coffee there.

However, the smallness of those decisions accumulate over days and months and years, eventually making a significant impact throughout the course of a lifetime.

As Shane Parrish writes, “today’s choices become tomorrow’s reality.”

Again, similar to physical health, positive financial inputs today (saving money and investing) result in exponentially positive outputs in the long run (cash flow and returns).

This is real, down-to-earth financial advice I wish I would have known earlier in my life. It has helped me and my wife save and invest over the last 7 years all while traveling the world, eating well, and paying off our student loans.

I’m not a financial expert and this advice is just that — advice. But I hope that at least some of this advice will be helpful for you, too.

Financial Hierarchy of Needs

At the heart of solid financial health is a basic understanding of where you should be allocating and saving money — and how much — and when. This was always a mystery to me until I spoke with the team over at Wealthfront.

From that conversation I developed what I like to call, with much creativity and originality, the Financial Hierarchy of Needs.

The Financial Hierarchy of Needs (FHoN) is a baseline for most of what you need to know about managing your money and building wealth. It’s how you can live for today and save money for tomorrow.

FHoN is made up of 4 main components:

Understanding and leveraging debt

Saving

Investing

Growth

Like Maslow’s Hierarchy of Needs, FHoN reflects more universal financial “needs” at its base and then moves upward towards more complex financial strategies towards the top. Of course, finances are nuanced and can have parallel strategies running at the same time. Therefore, many different strategies from various levels of FHoN can occur simultaneously.

Let’s start with understanding and leveraging debt.

Not All Debt is Bad Debt

Not all debt is created equal.

When used strategically, debt can help you save money and build wealth by providing access to assets (such as real estate) that you wouldn’t otherwise be able to purchase at once — more on that later.

The key to effectively managing debt is understanding interest rates and opportunity costs associated with each loan you take on.

For example, let’s say you owe $50K on your student loans at a 5% interest rate. How much should you pay per month?

It depends.

Credit Karma Loan Calculator: https://www.creditkarma.com/calculators/debt_repayment/

In the chart above, increasing your monthly student loan payment from $300 to $360 per month saves you 78 months (6.5 years) of payments and $10,702 in interest.

When you pay off debt, it’s like seeing a guaranteed return on investment. So, if your average student loan interest rate is 5%, paying off your loans early is like getting a 5% return.

Though that doesn’t mean you should pay $60 more per month on student loans.

Let’s say you invested that $60 dollars — over the same 286 months — in the stock market with an average return of 7% YoY.

That initial investment of $60 at 7% return YoY would be worth roughly $40,000 at the end of 286 months (before taxes). In this example, you would have earned nearly $30,000 dollars by investing instead of paying down debt.

The point is you need to first understand the options and risks associated with paying down debt. Don’t blindly throw a majority of your earnings at your debt when there are potentially better financial opportunities to be pursued.

Saving Money

Whether you have $5 or $500 left at the end of the month, it’s critical that you start to save money starting today. Saving money gives you peace of mind and it gives you options down the road.

Think about it this way: Over time, you’ll actually have to work less and less as your money works more and more, and eventually, you might be able to stop working altogether.

Start with an emergency fund. Similar to startup businesses, your emergency fund should be about three months of your total expenses. For example, if your total monthly expenses are $4,000, you should have roughly $12,000 in savings.

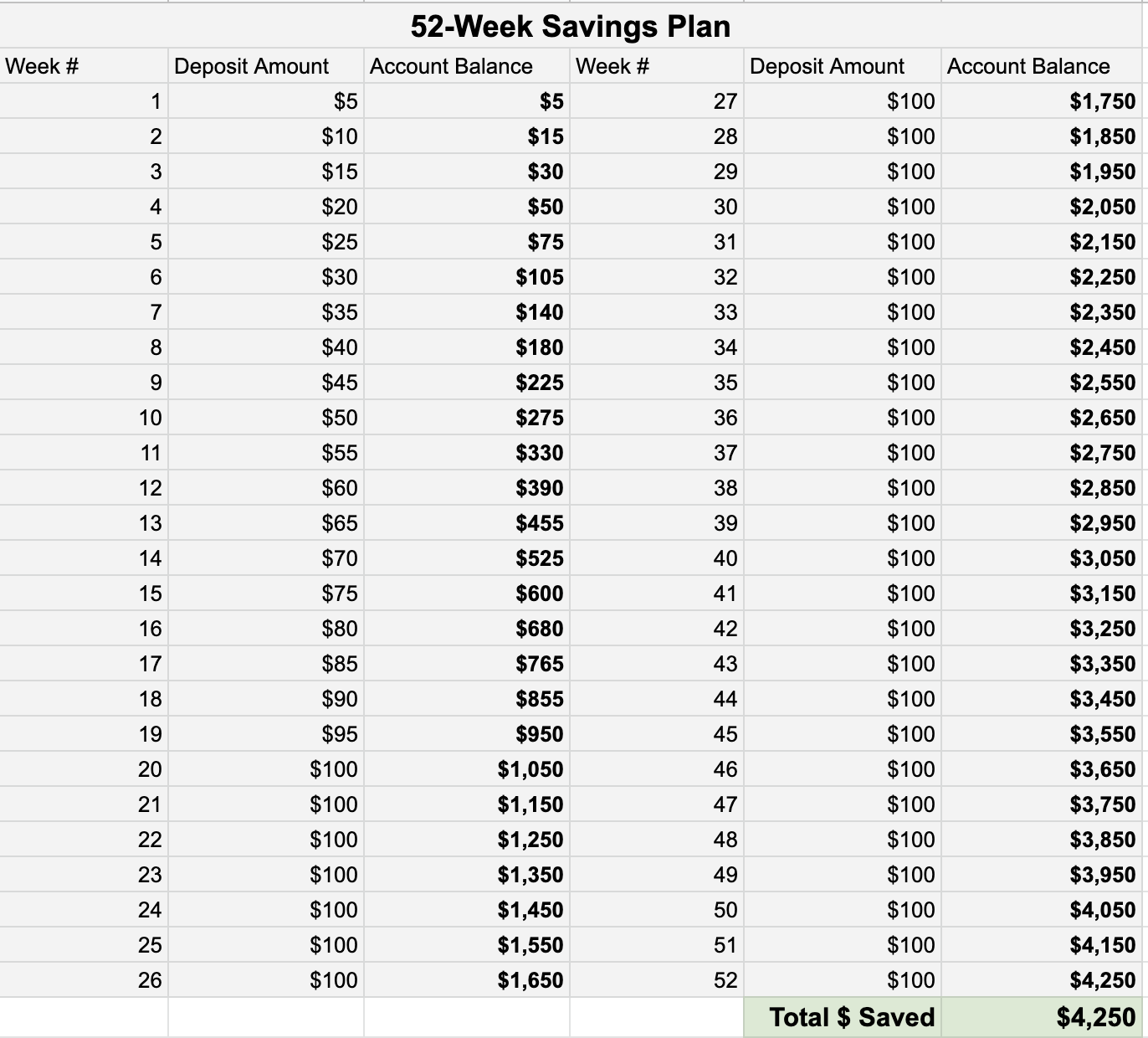

How to save $4,250 in one year (https://docs.google.com/spreadsheets/d/1NHZJYYAGUj7AomZW_n4a8H203z-rSJjRnNZigj67E-k/edit?usp=sharing)

In addition to an emergency fund, young people should be saving anywhere between 10–30% of their total pay check. 10–17% of that should be directed towards a Roth or Traditional 401K and the remaining towards your emergency fund.

Tip: I highly recommend exploring a Wealthfront Cash Account — which offers an industry-leading 2.32% APY (at the time of writing) with no fees, unlimited transfers, and FDIC insurance covering up to $1 million.

Investing Money

“Investment is most intelligent when it is most businesslike.”

–Benjamin Graham, The Intelligent Investor

So you have a nice little IRA going and your emergency fund is in place…

Now what? The real fun begins.

There are a variety of ways to invest your extra cash. From online brokers like E*TRADE and Fidelity to mutual funds and bonds, each avenue offers its own set of benefits and risks.

For the sake of time, I’ll share my strategy and the results I’ve seen over the last several years.

Roboadvisors

After the 2008 financial crisis, a new breed of investment advisor was born: the roboadvisor. Jon Stein and Eli Broverman of Betterment are often credited as the first in the space. Their mission was to use technology to lower costs for investors and streamline investment advice.

Since Betterment launched, other robo-first companies have been founded (such as Wealthfront, SoFi, Ally Invest, and M1 Finance) and they’re becoming highly appealing to tech savvy young professionals and older generations alike.

According to a report by Charles Schwab, 58% of Americans say they will use some sort of robo-advice by 2025. If you want an algorithm to make investment decisions for you, including tax-loss harvesting and rebalancing, a roboadvisor may be for you. And as the success of index investing has shown, if your goal is long-term wealth building, you just might do better with one of these firms.

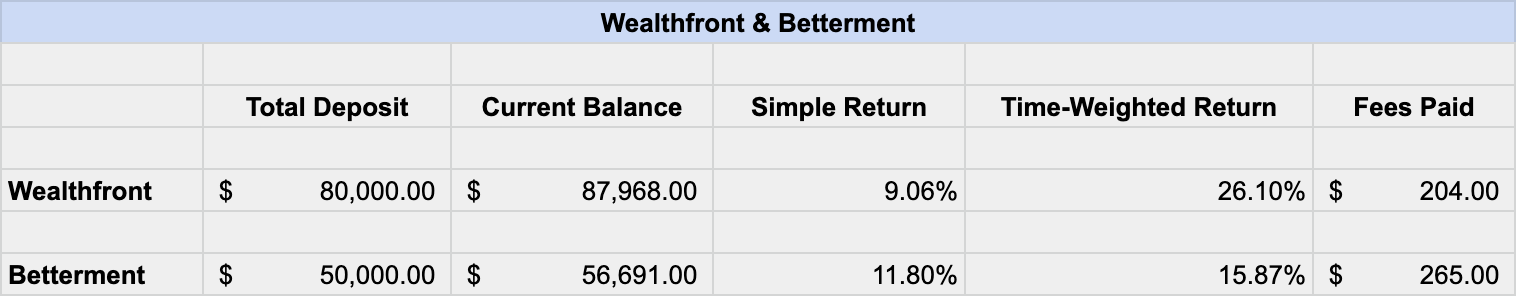

For fun, I chose to split my investment money between Wealthfront and Betterment to see how each performed. One year after my experiment began, here are the results:

I don’t know about you, but I will gladly pay $17–$22/month for an algorithm to manage my money for me with a simple return rate between 9–12%.

Investing is not to be taken lightly, but it’s not something to be afraid of, either. If you want to learn more, I’d start with the wisdom from none other than the legend himself, Warren Buffet.

Here are a few of Buffet’s fundamentals on investing:

You don’t need to be an expert in order to achieve satisfactory investment returns. But if you aren’t, you must recognize your limitations and follow a course certain to work reasonably well. Keep things simple and don’t swing for the fences. When promised quick profits, respond with a quick “no.”

Focus on the future productivity of the asset you are considering. If you don’t feel comfortable making a rough estimate of the asset’s future earnings, just forget it and move on. No one has the ability to evaluate every investment possibility. But omniscience isn’t necessary; you only need to understand the actions you undertake.

Games are won by players who focus on the playing field — not by those whose eyes are glued to the scoreboard. If you can enjoy Saturdays and Sundays without looking at stock prices, give it a try on weekdays.

Forming macro opinions or listening to the macro or market predictions of others is a waste of time. Indeed, it is dangerous because it may blur your vision of the facts that are truly important.

I specifically chose to leave out real estate as an investment option in this article because 1) I don’t own any real estate at the moment and 2) I don’t recommend purchasing real estate unless you’re at least somewhat financially stable, know where you want to live for the next several years, and/or can put at least 20% down.

If you’re interested, here’s a simple formula on how to know if you’re ready to buy property.

Growth and Money

Well, we’ve reached the top of the pyramid, so to say.

At this point, you have a wonderful flywheel of investment returns going as well as piece of mind knowing that there’s some cash saved away for a rainy day.

Now you can start to take some risks (only if you want to). There’s nothing wrong with sticking to what works and playing it safe with your money.

The way I think about Growth is this: taking a risk that you are confident in, but not completely sure about, with the possibility of that investment providing 10X returns of the course of its lifetime.

Here are just a few ideas to get the wheels turning:

Starting a side business

Angel investing

Picking high-growth stocks

Creating an online course

Building an app

Gambling (kidding)

Recently, my brother and I started a little side project we call the Unicorn Club. Every January we both start by depositing $500 into Robinhood — each having to buy $500 worth of an individual company stock.

Then, at the beginning of the following month, we record the total return on investment (%) from that stock over the course of the previous 30 days.

Once recorded, we have the option to either sell all of the shares we purchased the month before, or, hold onto those shares and invest another $100 into Robinhood and purchase a new stock.

The process repeats until Christmas where the loser (the person with the lowest total ROI) has to buy a round of beers. At which point we’re both a little intoxicated and a whole lot wealthier.

P.P.S. If you enjoyed this article, you may also enjoy my other musings. I write about life stuff such as happiness, investing(!), traveling, decision making (and lots more) in my newsletter, Thinker.